PDF Editors for Accountants, Invoice Editing & Financial Data Protection

- PDF Editor

- October 8, 2025

- No Comments

The reliance on digital tools for managing invoices, financial data, and compliance has never been greater. Highlighting PDF editors for accountants, invoice editing, financial data protection, these sophisticated tools are transforming traditional workflows, reducing errors, and fortifying sensitive data against cyber threats. For accountants, the ability to efficiently edit, review, and secure PDF documents—specifically invoices and related financial records—is crucial.

Highlighting PDF editors for accountants, invoice editing, financial data protection, these sophisticated tools are transforming traditional workflows, reducing errors, and fortifying sensitive data against cyber threats.

As financial regulations tighten and the demand for accuracy grows, mastering professional PDF editing software is no longer optional but essential for modern accounting practices.

Top PDF Editors for Accountants: Streamlining Invoice Workflows

Choosing the right PDF editors for accountants can significantly impact an accountant’s workflow efficiency. Top-tier PDF editors designed for accounting professionals often feature intuitive interfaces, batch processing capabilities, and integration with accounting software. These PDF editors for accountants tools allow accountants to quickly annotate, merge, split, or redact invoice documents without disrupting their workflow, saving valuable time during busy periods like month-end reporting or tax season.

The ability to consistently streamline invoice processing fosters accuracy, minimizes manual errors, and ensures that deadlines are consistently met, which ultimately enhances client satisfaction and operational efficiencies.

Furthermore, many leading PDF editors for accountants incorporate cloud-based functionalities, enabling remote access and collaboration while maintaining version control. This flexibility means accountants can review and edit invoices anytime, anywhere, and share revisions seamlessly with clients or colleagues. In a competitive landscape, adopting top PDF editors for invoice management can be a game-changer by optimizing productivity, improving data accuracy, and reinforcing a reputation for professionalism and reliability.

Invoice Editing Capabilities in PDF Editors: A Must-Have for Accountants?

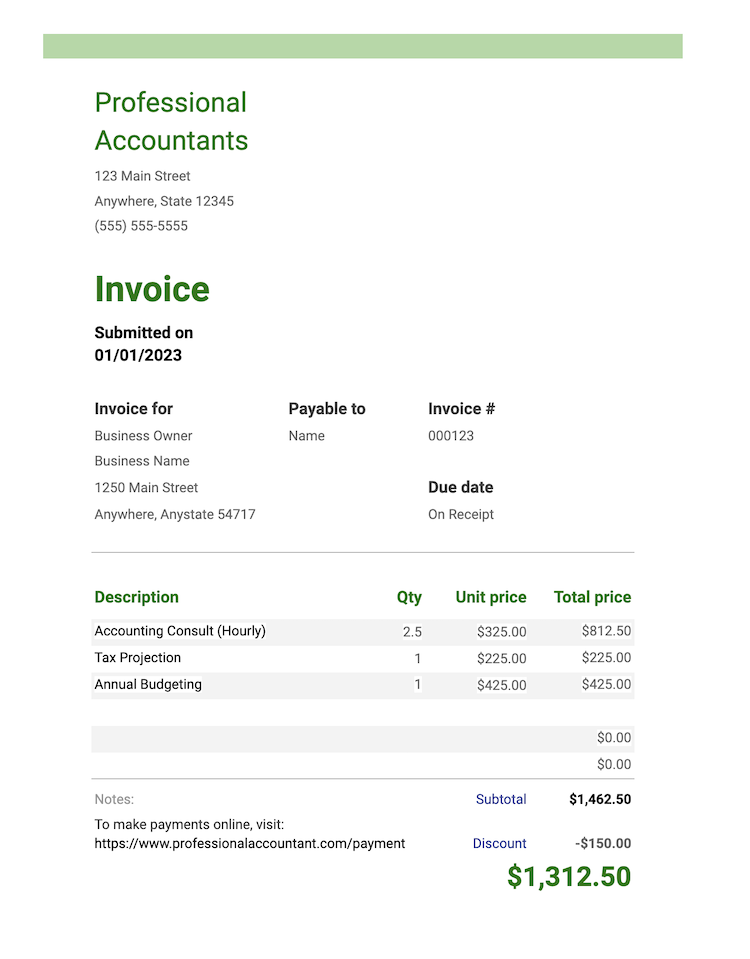

Invoice editing capabilities in PDF editors are vital for accountants who need to modify, correct, or update financial documents swiftly. Robust invoice editing features—such as editable text, drag-and-drop fields, and automatic form recognition—significantly reduce turnaround times. For example, the ability to efficiently update invoice amounts, dates, or client details directly within a PDF streamlines what used to be a manual or systemic process, making workflows more agile.

Beyond basic editing, advanced features like OCR (Optical Character Recognition) enable accountants to convert scanned invoices into editable PDFs, further broadening the utility of these tools. This makes it possible to work with a variety of invoice formats without worrying about incompatible or non-editable files.

Overall, these capabilities aren’t luxuries but essentials, empowering accountants to respond quickly to client needs, rectify discrepancies promptly, and maintain impeccable record accuracy—all critical for swift invoicing cycles and regulatory compliance.

Protecting Financial Data: Secure PDF Editing Practices for Accountants

Financial data protection is paramount for accounting firms, especially when handling sensitive invoices or client information. Proper PDF editors for accountants practices emphasize security measures like password protection, encrypted file transmission, and digital signatures. Secure PDF editors incorporate multi-layered encryption protocols, ensuring that valuable financial data remains confidential both during editing and storage. For accountants, leveraging these security features is non-negotiable, safeguarding against data breaches and unauthorized access.

In addition, implementing digital signatures within PDFs solidifies document authenticity and integrity, which is especially critical for audit-ready financial records. Secure handling of PDF files also involves maintaining detailed access logs, enabling audit trails and compliance verification.

By adopting secure PDF editors for accountants practices, accountants not only protect their clients’ data but also adhere to industry standards and legal regulations, building trust and minimizing the risk of costly penalties linked to data breaches or non-compliance.

Comparing PDF Editors: Features Crucial for Invoice Management and Financial Security

When selecting a PDF editor for accounting purposes, it’s essential to evaluate features that directly impact invoice management and financial data security. Key functionalities include robust editing tools, form recognition, automation capabilities, and compliance features that meet industry-specific standards. For instance, some editors offer specialized invoice templates and batch processing, which accelerate repetitive tasks like bulk invoicing or corrections, ultimately reducing manual effort.

Equally important are security features such as encryption, access controls, and audit logs. Not all PDF editors for accountants are created equal—some prioritize user-friendliness over security, while others strike a perfect balance. For accountants, finding an editor that combines advanced invoice editing tools with enterprise-grade security is fundamental to safeguarding sensitive financial data.

A comprehensive comparison that emphasizes these crucial aspects ensures the choice of a PDF editor capable of supporting meticulous invoice workflows while maintaining robust data protection.

Beyond Basic Editing: Advanced PDF Features Accountants Need for Invoice Processing

While basic editing functions are helpful, advanced PDF features provide accountants with greater control and efficiency in invoice processing. Features like batch processing, automated data extraction via OCR, customizable templates, and integrated digital signatures transform casual editing into streamlined operations. These capabilities reduce manual input, minimize errors, and generate audit-friendly records, which are vital for compliance and financial accuracy.

Moreover, the integration of data analytics tools within PDF editors for accountants offers insights into invoice patterns, overdue payments, and client activity, enabling smarter decision-making. Advanced features such as redaction tools allow accountants to remove sensitive information before sharing files externally, bolstering confidentiality and data security. Embracing these sophisticated functionalities elevates an accountant’s ability to handle high volumes of invoices with precision, speed, and security, ultimately improving productivity and data integrity.

The Risks of Free PDF Editors: Prioritizing Financial Data Protection

While free PDF editors for accountants may seem attractive due to cost savings, they often come with significant risks in terms of security and functionality. Many free tools lack the necessary security features such as encryption and user access controls, leaving sensitive financial information vulnerable to cyber threats and data breaches. For accountants handling confidential invoices, these vulnerabilities are unacceptable given the potential legal and reputational consequences.

Additionally, free PDF editors for accountants generally offer fewer or no advanced features like OCR, batch processing, or digital signatures, limiting professional capabilities. Weak or absent support can also pose challenges when technical issues arise, leading to workflow disruptions. For financial data protection, it is vital to invest in reputable, secure PDF editing solutions that meet industry standards—if not, the potential costs of data breaches or compliance violations far outweigh savings from free tools.

Choosing the Right PDF Editor: A Checklist for Accountants

Selecting an appropriate PDF editors for accountants involves considering several vital criteria. First, assess the security features—does the tool offer encryption, access controls, and audit trails? Second, evaluate the editing capabilities—are features like OCR, form recognition, and batch processing available?

Third, consider integration options—can the software seamlessly connect with accounting and ERP systems? Also, determine ease of use and customer support quality to ensure quick onboarding and ongoing assistance. Accounting workflows demand reliability, consistency, and security—so a thorough evaluation aligned with these needs is essential.

Furthermore, compliance features such as digital signatures, audit logs, and adherence to standards like GDPR or HIPAA should be part of your checklist. Flexibility and scalability are also important, especially for growing firms. By methodically analyzing these factors, accountants can make confident choices that enhance productivity while maintaining rigorous security standards—an investment that pays dividends in operational efficiency and trustworthiness.

Invoice Automation with PDF Editors: Saving Time and Reducing Errors

Automation capabilities embedded within PDF editors for accountants serve as powerful tools for reducing manual effort and minimizing errors in invoice processing. Automated data extraction via OCR technology allows accountants to convert paper invoices into editable and searchable PDFs effortlessly. Bulk processing features streamline repetitive tasks such as editing, sorting, or filing invoices, creating a more efficient workflow overall.

Implementing automation not only saves time but also enhances accuracy—reducing the likelihood of human errors such as miskeyed amounts or incorrect client details. These PDF editors for accountants technologies can be configured to trigger alerts for overdue payments or discrepancies, enabling proactive management.

In the era of digital transformation, automation through feature-rich PDF editors for accountants empowers accountants to focus more on strategic financial analysis rather than tedious manual tasks, delivering better client service and more precise records.

Compliance and PDF Editing: Meeting Regulatory Requirements for Financial Records

Regulatory compliance remains a critical concern in accounting, mandating that financial records are accurate, secure, and accessible for audits. Advanced PDF editing tools facilitate compliance by supporting digital signatures, ensuring document authenticity and non-repudiation. Encryption features safeguard sensitive information, while metadata controls prevent unauthorized modifications—both essential for audit confidence.

Additionally, many PDF editors for accountants include version control, audit logs, and timestamps aligned with legal requirements, ensuring transparency of changes made to financial documents. These features help firms meet standards set by authorities such as GDPR, HIPAA, or industry-specific financial regulations. For accountants, leveraging compliant PDF editing solutions reduces legal risks, simplifies audit processes, and ensures that financial data handling aligns with best practices and regulatory mandates.

Future of PDF Editing in Accounting: Trends and Innovations to Watch

The landscape of PPDF editors for accountants is evolving rapidly, driven by technological innovations. Cloud-based platforms are becoming increasingly popular, offering real-time collaboration, automatic updates, and enhanced security features. Artificial intelligence and machine learning are beginning to automate complex invoice data extraction and categorization, significantly reducing manual effort and errors.

Furthermore, blockchain integration holds promise for creating immutable and transparent records, reinforcing trust in digital financial documents. Augmented reality (AR) and mobile optimization are also enhancing the accessibility of complex PDF editors for accountants outside the traditional office setting.

Accountants who stay attuned to these trends can leverage future-ready tools that further streamline operations, safeguard data, and meet evolving regulatory standards—positioning their practices at the forefront of innovation and compliance.

Relevant Reads:

Best PDF Editor 2025: Top Tools, Features, and Free Alternatives Compared

PDF Editors for Lawyers: Legal Document Management

Conclusion

In managing invoices and safeguarding financial data, the importance of choosing the right PDF editors for accountants|invoice editing|financial data protection cannot be overstated. Advanced capabilities such as secure editing, automation, compliance support, and integration with accounting platforms are essential to streamline workflows, minimize errors, and maintain the highest standards of data security.

As technology progresses, staying informed about emerging trends and investing in reliable, feature-rich PDF tools will empower accountants to meet the growing demands of accuracy, efficiency, and regulatory compliance—making every financial record a secure and strategic asset for their practice.